Top Equity Loans for Homeowners: Obtain the Best Prices

Top Equity Loans for Homeowners: Obtain the Best Prices

Blog Article

Optimize Your Assets With a Strategic Home Equity Car Loan Plan

In the realm of financial monitoring, one commonly seeks methods to optimize possessions and make critical decisions that yield long-term advantages. One such avenue that has actually amassed focus is the use of home equity through an attentively crafted funding plan. By tapping right into the equity developed within your home, a wide variety of opportunities emerge, providing a prospective increase to your monetary portfolio. The essential exists not just in accessing these funds however in creating a tactical strategy that maximizes their potential. As we browse the intricate landscape of home equity loans, the importance of mindful planning and insight ends up being significantly apparent.

Comprehending Home Equity Finances

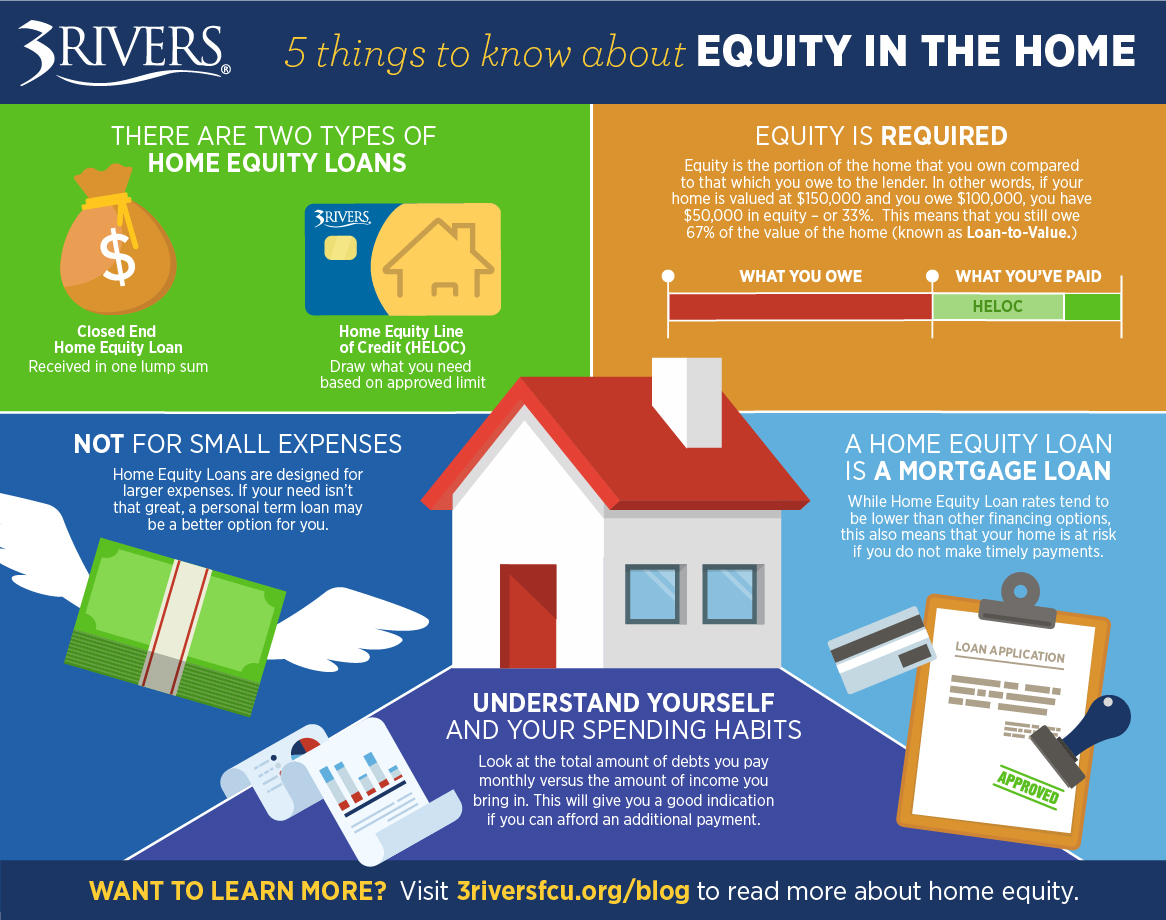

An extensive understanding of the complexities bordering home equity loans is fundamental for enlightened economic decision-making. Home equity loans permit home owners to take advantage of the equity constructed up in their residential or commercial property to gain access to funds for various purposes. One vital facet to recognize is that these car loans are safeguarded by the value of the home itself, making them much less high-risk for loan providers and usually causing reduced passion prices for borrowers compared to unsecured finances.

Moreover, understanding the loan-to-value proportion, settlement terms, potential tax effects, and the risks included in using your home as collateral are essential elements of making audio monetary choices concerning home equity finances. By obtaining an extensive understanding of these aspects, house owners can utilize home equity car loans strategically to attain their financial goals.

Benefits of Leveraging Home Equity

Utilizing the equity in your home can supply a series of monetary advantages when purposefully leveraged. One of the key benefits of leveraging home equity is accessibility to large amounts of cash at reasonably low rate of interest prices compared to various other types of borrowing. By using your home as security, lending institutions are a lot more ready to offer favorable terms, making home equity financings an appealing alternative for funding significant expenses such as home renovations, education costs, or debt consolidation

In addition, the rate of interest paid on home equity car loans is frequently tax-deductible, offering potential financial savings for house owners. This tax advantage can make leveraging home equity even more affordable contrasted to various other kinds of finances. Furthermore, home equity financings generally supply longer payment terms than individual lendings or charge card, enabling more convenient regular monthly repayments.

Furthermore, by reinvesting obtained funds right into home improvements, house owners can potentially enhance the worth of their residential or commercial property. This can result in a higher resale worth or improved living conditions, additionally boosting the economic benefits of leveraging home equity. In general, leveraging home equity wisely can be a strategic economic step with numerous benefits for house owners.

Strategic Planning for Lending Usage

Having developed the benefits of leveraging home equity, the next important action is tactically intending for the application of the loan earnings - Home Equity Loan. When considering how to ideal make use of the funds from a home equity loan, it is necessary to have a clear plan in position to take full advantage of the benefits and ensure financial security

One critical strategy is to make use of the financing proceeds for home enhancements that will raise the building's value. Remodellings such as kitchen upgrades, bathroom remodels, or including extra living room can not just enhance your everyday living experience yet likewise enhance the resale worth of your home.

One more prudent use home equity finance funds is to combine high-interest financial obligation. By paying off bank card, personal fundings, or various other debts with lower rate of interest proceeds from a home equity financing, you can save money on rate of interest payments and streamline your funds.

Finally, purchasing education and learning or moneying a major expenditure like a wedding event or medical bills can likewise be strategic uses of home equity financing funds. By thoroughly intending just how to assign the proceeds, you can take advantage of your home equity to achieve your financial objectives successfully.

Factors To Consider and dangers to Keep in Mind

Thinking about the prospective pitfalls and factors to consider is important when considering the use of a home equity loan. Among the key threats connected with a home equity financing is the possibility of failing on payments. Since the loan is secured by your home, failure to repay could lead to the loss of your residential property via foreclosure. It's necessary to examine your economic security and ensure that you can conveniently manage the additional financial obligation.

One more consideration is the ever-changing nature of rate of interest prices (Equity Loan) (Alpine Credits copyright). Home equity fundings typically feature variable rate of interest, suggesting your regular monthly repayments might increase if passion prices rise. This prospective increase should be factored into your monetary planning to prevent any type of shocks down the line

In addition, be click site cautious of overborrowing. While it might be appealing to access a large amount of money with a home equity lending, just obtain what you genuinely require and can afford to repay. Mindful consideration and prudent monetary management are key to effectively leveraging a home equity car loan without falling under economic difficulties.

Tips for Effective Home Equity Car Loan Management

When navigating the realm of home equity lendings, sensible financial monitoring is essential for optimizing the benefits and reducing the connected threats. To properly take care of a home equity car loan, start by creating a comprehensive budget plan that details your regular monthly revenue, costs, and lending repayment commitments. It is crucial to focus on timely settlements to prevent charges and keep a great credit rating.

Regularly monitoring your home's value and the equity you have built can aid you make informed decisions regarding leveraging your equity even more or readjusting your payment method - Home Equity Loan. Additionally, think about establishing automated payments to make certain that you never ever miss out on a due date, hence protecting your financial standing

One more pointer for effective home equity car loan management is to discover opportunities for refinancing if rate of interest drop considerably or if your credit history improves. Refinancing might possibly reduce your monthly settlements or enable you to pay off the loan much faster, saving you money in the long run. By adhering to these approaches and staying aggressive in your economic planning, you can efficiently handle your home equity finance and take advantage of this important economic tool.

:max_bytes(150000):strip_icc()/dotdash-home-equity-vs-heloc-final-866a2763fd0548eaa393afa0ffd7372b.jpg)

Final Thought

To conclude, calculated preparation is crucial when utilizing a home equity car loan to take full advantage of properties. Understanding the benefits and dangers, as well as carefully thinking about how the funds will certainly be used, can assist guarantee effective administration of the finance. By leveraging home equity carefully, individuals can take advantage of their properties and attain their economic goals.

Home equity fundings permit house owners to leverage the equity built up in their residential property to accessibility funds for various purposes. By using your home as collateral, lenders are much more willing to provide favorable terms, making home equity financings an eye-catching option for funding major expenditures such as home renovations, education and learning expenses, or financial debt loan consolidation.

In addition, home equity car loans typically supply longer repayment terms than individual car loans or credit report cards, allowing for even more convenient monthly payments.

Mindful factor to consider and sensible monetary management are key to efficiently leveraging a home equity financing without dropping into monetary problems.

To successfully take care of a home equity funding, start by developing a thorough budget plan that describes your month-to-month income, expenses, and financing payment commitments.

Report this page